Powering Innovative

Retirement Solutions

372M

ASSETS UNDER MANAGEMENT (AUM)1

210%+

3-YEAR COMPOUND ANNUAL GROWTH RATE2

B+

FINANCIAL RATING

AM Best 3

Outlook: Stable

”

We believe there are significant opportunities for NexAnnuity to drive innovation in the annuity market and provide individuals with tailored annuity solutions that can help them secure a better future during retirement.

-Brad Heiss, Executive Vice President & Chief Investment Officer, NexAnnuity

HISTORIC GROWTH

Tripled Sales in 2022

NexAnnuity’s Fixed Annuity Platform, Backed by The Ohio State Life Insurance Company

100M

2022 TOTAL SALES4

275M

TOTAL ASSETS5

95

SALES GROWTH6

70

ASSET GROWTH7

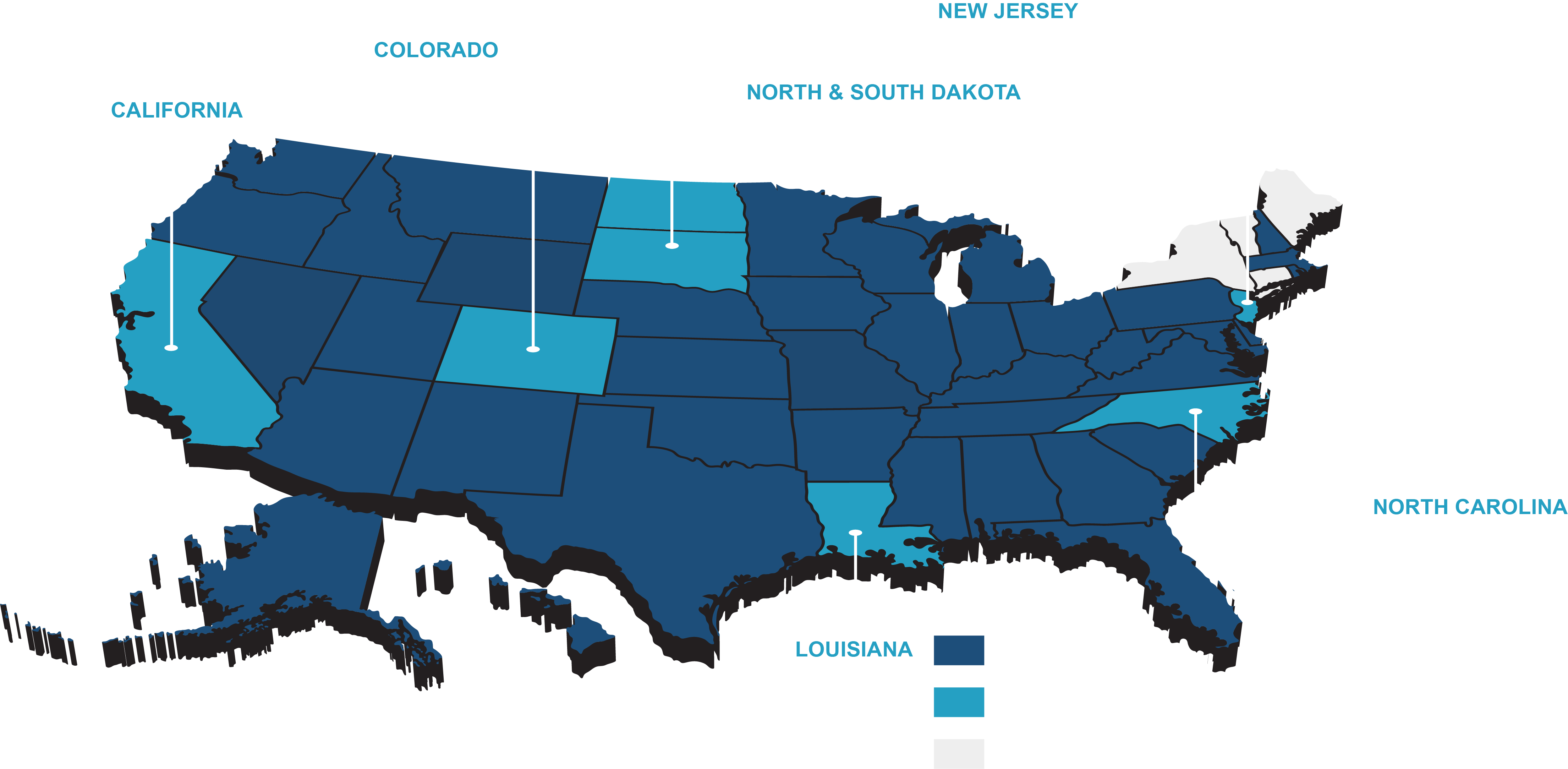

PRODUCT AVAILABILITY

NexAnnuity Expands Product Availability in Several States Increasing Total Agent Count

In 2022, NexAnnuity was approved in California, Colorado, Louisiana, North Carolina, North Dakota, South Dakota, and New Jersey, bringing the total product availability to 46 states and the District of Columbia with plans to expand in 2023.

793

NUMBER OF APPOINTED AGENTS

*as of 12/31/2022

40

OF AGENTS SELLING

AFFILIATED COMPANIES

NexAnnuity Expands Distribution with Strategic Partnerships: NexPoint and Advisor Equity Group

650%

NexPoint Annuity Sales Growth8

Dedicated Regional Wholesalers

Dedicated Annuity Wholesalers in Four Regions spanning the US

Fixed Annuities

Through Ohio State Life

Fixed Index Annuities

Through Advisors Equity Group

WHAT'S AHEAD

New Products Coming Soon

Fixed Index Annuities

Fee-Only Multi-Year Guaranteed Annuities

Single Premium Immediate Annuities and More!

© 2023 NexAnnuity All rights reserved.

1.As of 12/31/2022, NexAnnuity Asset Management, L.P. (“NAM”) based on fee calculating AUM. NAM is an SEC registered investment advisor and advisor to OSL. 2. OSL total asset growth from 2019-2022. 3. AM Best assigned OSLIC a financial strength rating of B+ (Good) on February 21, 2023. For the latest AM Best Credit Rating, access www.ambest.com. 4. OSL sales in 2022 5. OSL GAAP total assets as of 12/31/2022 6. OSL change in sales growth YOY from 2021-2022 7. OSL GAAP total asset YOY 2021-2022 8. NexPoint Securities, Inc. sales growth YOY from 2021-2022

This material is intended to provide educational information regarding the features and mechanics of the products and is intended for use with the general public. It should not be considered and does not constitute personalized investment advice. The issuing insurance company is not an investment adviser nor registered as such with the SEC or any state securities regulatory authority. The issuing insurance company is not acting in any fiduciary capacity with respect to any contract and/or investment.

Nex MYGA annuities are issued by The Ohio State Life Insurance Company, Administrative Office PO BOX 25417 Salt Lake City, UT 84125 (“Ohio State Life”). Available in most states under contract form series ICC21 NA001_Rev, ICC21 NA001-APP_Rev, ICC21 NA001R1_Rev, ICC21 NA001R2_Rev, ICC21 NA001R3_Rev and state variations thereof. Rider benefits and rider form numbers may vary by state. Insurance and annuity products, optional features, and riders are not available in all states and may be subject to firm availability. Click here to see current product availability. Ohio State Life is not licensed in Connecticut, Maine, New York, or Vermont, and operates in California with license number 08115. Annuities contain features, exclusions and limitations that vary by state. Read the contract for complete details. Payment obligations and guarantees are subject to the financial strength and claims-paying ability of Ohio State Life. Ohio State Life may change or discontinue a product at any time.

ANNUITIES ARE PRODUCTS OF THE INSURANCE INDUSTRY AND NOT GUARANTEED BY ANY BANK NOR INSURED BY FDIC OR NCUA/NCUSIF. ANNUITIES MAY LOSE VALUE AND HAVE NO BANK/CREDIT UNION GUARANTEE. ANNUITIES ARE NOT A DEPOSIT AND ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. ANNUITIES MAY ONLY BE OFFERED BY A LICENSED INSURANCE PRODUCER/AGENT. This material should not be interpreted as a recommendation by NexAnnuity or Ohio State Life.

Withdrawals of taxable amounts from an annuity are subject to ordinary income tax, and, if taken before age 59½, may be subject to a 10% IRS penalty. Any discussion or mention of taxes is for general informational purposes only, does not purport to be complete or cover every situation, and should not be construed as legal, investment, tax or accounting advice. NexAnnuity, Ohio State Life and their affiliates, including any distribution partners, do not offer legal, investment, tax or accounting advice. Please consult your own qualified legal, investment, tax and accounting advisors.

“NexAnnuity” and “Nex” are used as marketing names for NexAnnuity Holdings, Inc., its subsidiaries and some affiliates, including The Ohio State Life Insurance Company. Each subsidiary or affiliate is responsible for its own financial and contractual obligations. Certain subsidiaries and affiliates, including The Ohio State Life Insurance Company, are not authorized to do business in New York.