NexAnnuity is committed to developing and delivering solutions for modern retirement needs

Traditional retirement products do not reflect the modern financial landscape. NexAnnuity’s mission is to develop and deliver solutions that address the needs of current and future retirees. By leveraging the resources of our established investment network, financial services expertise, and efficient operating model, we seek to drive value for our clients and partners.

Modernizing insurance and annuity products

NexAnnuity was established to advance retirement solutions, bringing innovation and efficiency to the life insurance and annuity space. The market for insurance and annuity products has failed to keep up with significant changes in regulation, demographics, and other major areas. These are secular trends that will continue to drive demand for effective retirement solutions.

Innovative Retirement Solutions Powered by NexAnnuity.

Choose a longstanding insurance provider

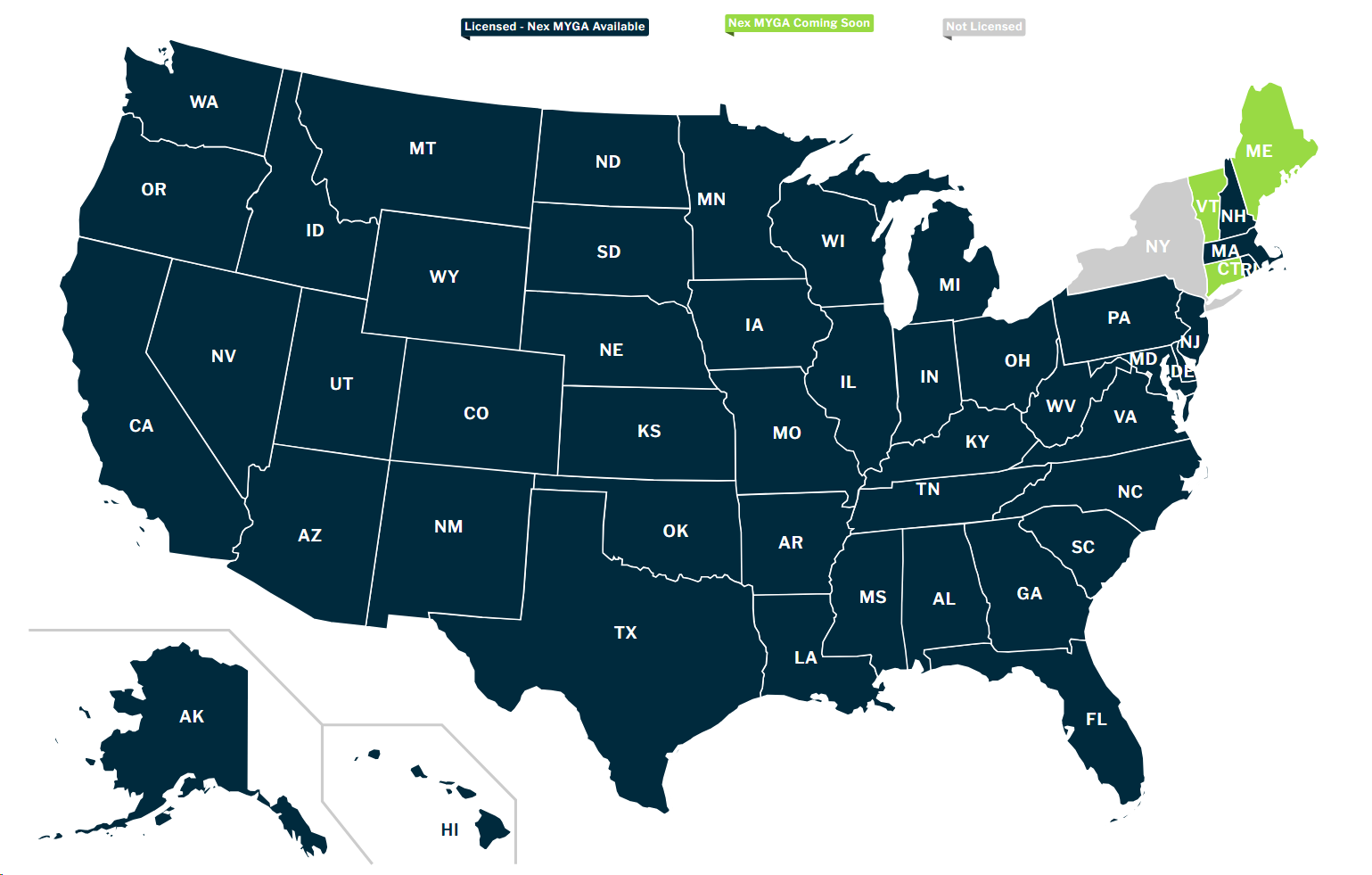

Ohio State Life, a NexAnnuity company, has been in operation for over 115 years and holds licenses in 46 states and the District of Columbia.

This partnership approach, supported by the expertise of leading service providers, helps ensure best-in-class customer service and highly efficient business operations.

Rely on our experienced financial services

NexAnnuity’s retirement solutions draw on expertise and resources from an integrated network of finance and investment businesses. These affiliates provide strategic advantages for NexAnnuity, offering an efficient way to access a range of capabilities that support the development and management of annuity and insurance products.

Access new and creative retirement solutions

NexAnnuity develops new and creative retirement solutions with leading rates in the annuity industry.

Our unique access to investment expertise and operational resources creates efficiencies that benefit policy owners through a leading crediting rate, as well as advisors through leading commissions.

The “Nex” Name

Investment experience that spans asset classes and strategies through our established investment network.

The Nex entities operate complex and highly regulated businesses where compliance and oversight are critical functions.

AUM: $16.1 Billion 2

An investment platform that consists of several SEC-registered investment advisors, sponsors, and a FINRA regulated broker-dealer. Combined, NexPoint offers a suite of investment vehicles and products across credit, real estate, structured products, equities, and alternatives to institutional and retail clients.

ASSETS: $708 Million 3

NexAnnuity Retirement Solutions (“NexAnnuity”), through a group of investment and insurance businesses, offers annuities, insurance services, and investment solutions to clients in the US. Annuities are offered through The Ohio State Life Insurance Company, whose primary regulator is the Texas Department of Insurance, and was founded in 1906.

1 Based on total assets for banks headquartered and operating in Texas (Source: S&P Global Market Intelligence). As of 03/31/2025. 2 Inclusive of NexPoint

Advisors, L.P. and affiliates, based on fee calculation AUM. Note: Financial information as of 03/31/2025. 3 NexAnnuity Holdings, Inc. as of 03/31/2025

The Ohio State Life Insurance Company

Ohio State Life offers unique annuity products designed to grow retirement income while protecting principal. Ohio State Life partners with best-in-class service providers to deliver industry leading crediting rates for our policy owners. Currently, Ohio State Life holds licenses in 46 states and the District of Columbia.

NexAnnuity Product Availability

This material is intended to provide educational information regarding the features and mechanics of the products and is intended for use with the general public. It should not be considered, and does not constitute, personalized investment advice. The issuing insurance company is not an investment adviser nor registered as such with the SEC or any state securities regulatory authority. The issuing insurance company is not acting in any fiduciary capacity with respect to any contract and/or investment.

Annuities are issued by The Ohio State Life Insurance Company, Administrative Office PO BOX 64528 St Paul, MN 55164 (“Ohio State Life”). Insurance and annuity products, optional features, and riders are not available in all states and may be subject to firm availability. Click here to see current product availability. Annuities contain features, exclusions and limitations that vary by state. Read the contract for complete details. Payment obligations and guarantees are subject to the financial strength and claims-paying ability of Ohio State Life.

ANNUITIES ARE PRODUCTS OF THE INSURANCE INDUSTRY AND NOT GUARANTEED BY ANY BANK NOR INSURED BY FDIC OR NCUA/NCUSIF. ANNUITIES MAY LOSE VALUE AND HAVE NO BANK/CREDIT UNION GUARANTEE. ANNUITIES ARE NOT A DEPOSIT AND ARE NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. ANNUITIES MAY ONLY BE OFFERED BY A LICENSED INSURANCE PRODUCER/AGENT. This material should not be interpreted as a recommendation by NexAnnuity or Ohio State Life.

“NexAnnuity” and “Nex” are used as marketing names for NexAnnuity Holdings, Inc., its subsidiaries and some affiliates, including The Ohio State Life Insurance Company. Each subsidiary or affiliate is responsible for its own financial and contractual obligations. Certain subsidiaries, including The Ohio State Life Insurance Company, are not authorized to do business in New York.